Social Finance is providing loans to local communities who are excluded from credit by the dramatic fall in bank lending. Groups and communities depending on social finance providers are experiencing no shortage of credit, according to a new report published by Clann Cedo – the Social Investment Fund.

The report,

From the Ground Up - How Social Finance can help Communities Regenerate & Create Jobs, explores

the role of the social economy in recovery, its potential to create jobs, the lessons we can learn from Scotland and the role of LEADER. It also recommends a number of initiatives to government to assist development of social enterprise and the social economy, including the development of Benefit Clauses (CBCs), Public Social Partnerships and Social Impact Bonds.

Drawing on 15 years experience of working in the field and a pioneering role in the development of social finance in Ireland, Clann Credo is putting forward these innovative proposals to help rejuvenate local economies and create jobs.

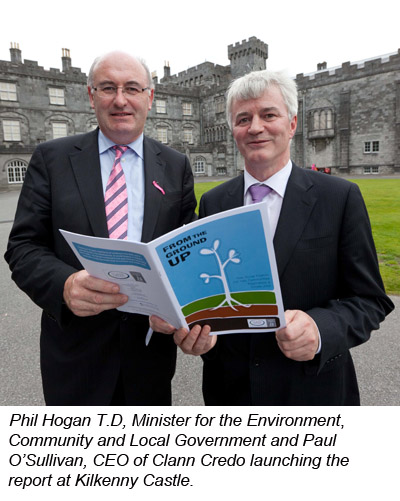

Speaking at the launch of the report in Kilkenny on Friday, 15 July, Phil Hogan, TD, Minister for Environment, Community and Local Government said: “Ireland lags significantly behind the rest of Europe in the number of social enterprise related jobs we provide and this report offers very useful suggestions to remedy this situation and on implementation of the Programme for Government in this area.”

Paul O’Sullivan, CEO of Clann Credo, added that the Irish social economy is uniquely placed to grow and make an enormous contribution to economic recovery.

“In Europe social enterprise accounts for between 4% and 7% of GDP, but in Ireland it represents just 3% of GDP. Achieving a European average of 5% of GDP would create thousands of new jobs in every corner of Ireland.

“Clann Credo’s goal is to ensure that all groups with repayment capacity, enjoy access to finance (on reasonable terms) and that no community is deprived of jobs or services just because they cannot access credit.

“Local organisations committed to improving their communities will benefit. Together with local development companies like, LEADER Partnerships, we can fill the gap left by the banking crisis and help our people re-build society from the ground up”, Paul O’Sullivan said.